What I said and wrote in the last couple of weeks

Student loans, the minimum wage, and what's going on with your electricity bill

Hi folks-

No media hits the past couple of weeks, but I’ve been staying busy with writing. Here’s what I’ve been up to.

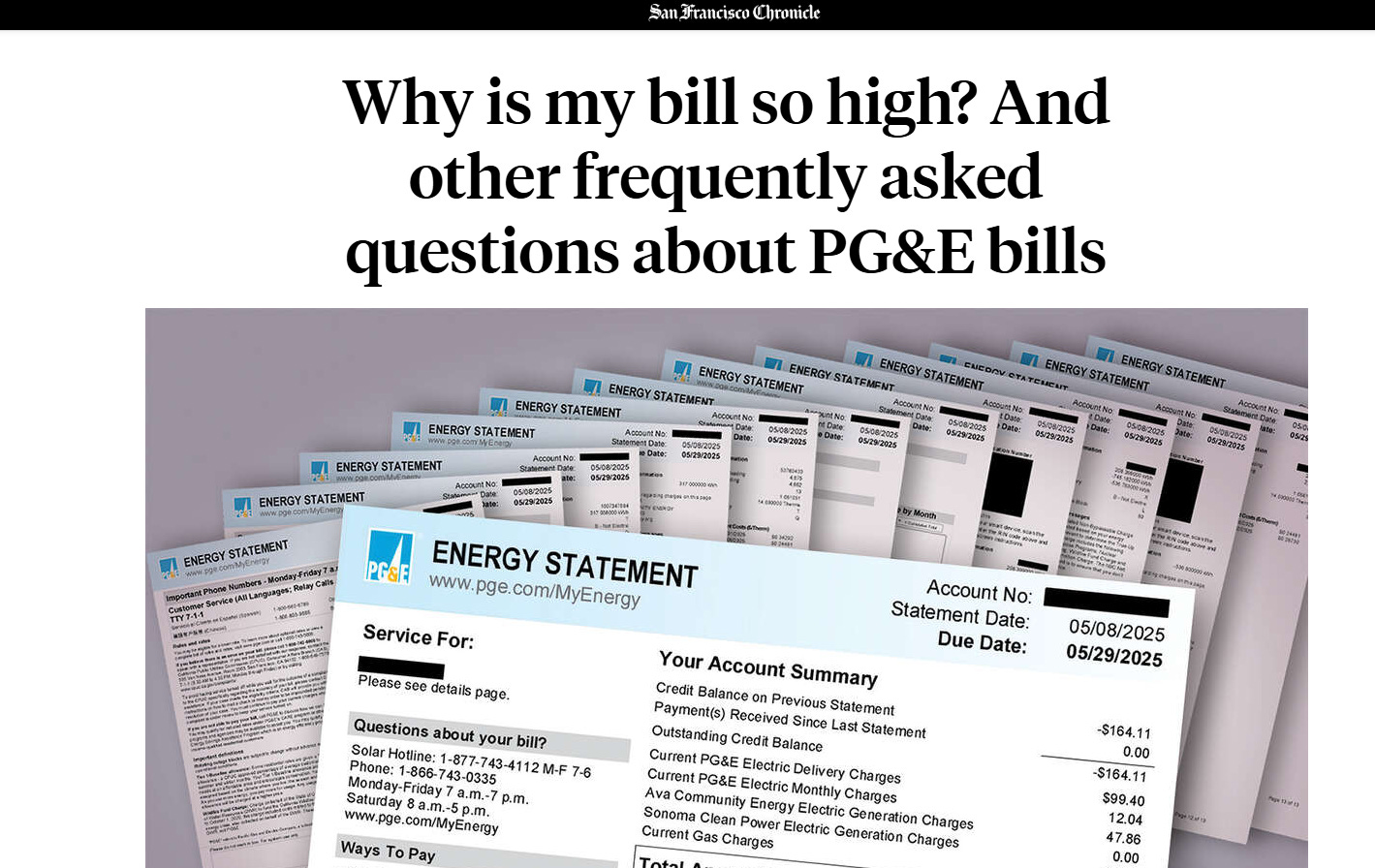

Why is my bill so high? And other frequently asked questions about PG&E bills - An FAQ on some of the most commonly asked questions readers have about their utility bills. What’s with the forecast alerts? When PG&E says I’m using more energy than “the average house of my size,” what does that mean? And why is my bill so high???

Is California one of the worst places to retire? What’s missing in a new ranking - A new study compared all 50 states as retirement destinations, and found — unsurprisingly — taxes are high in California. But they’re missing a lot of nuance about how state and property taxes work, and what a good deal some retirees are getting.

This Bay Area city is the fourth-most ‘impossibly unaffordable’ city in global ranking - Another less-than-surprising finding: It costs a lot to buy a house here. That’s one of many findings in this year’s “Silicon Valley Pain Index,” which measures regional economic inequality.

The Bay Area suburbs where renters are taking over the market - In some cities in the Bay Area, renters make up a single-digit percentage of the total household population. But in other suburban areas, two out of three households are renters. Why?

SAVE student loan plans resume interest Aug. 1. What borrowers should do now - Interesting responses from different experts on student loans about whether it’s best to refile or hold off right now if you were on the SAVE plan.

The minimum wage is set to rise in California on Jan. 1 - The law says California’s minimum wage has to be roughly pegged to inflation, unlike the federal minimum wage (which has been $7.25/hour since 2009.) Starting in January, the minimum wage here will be $16.90 an hour.

These are the best California community colleges for return on investment - California’s community college system serves millions of students. They’re all hoping for better jobs with better wages, but some of them are historically underserved students with very little information about the job market and how much more they’ll actually be making with a certificate or associate degree. A new study is trying to make that information more transparent by comparing median salaries of former students by college.

With some schools, former students make such a low median salary that it will take decades to pay off the cost of attending — and at others, the median salary is so low they’ll never recoup their investment.